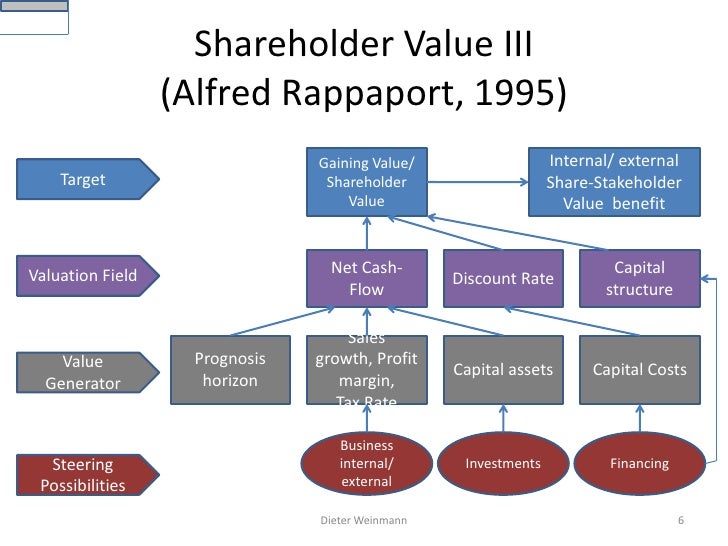

Alfred Rappaport 7 Value Drivers

%2C445%2C291%2C400%2C400%2Carial%2C12%2C4%2C0%2C0%2C5_SCLZZZZZZZ_.jpg)

Executive Summary Reprint: R0609C Executives have developed tunnel vision in their pursuit of shareholder value, focusing on short-term performance at the expense of investing in long-term growth. It’s time to broaden that perspective and begin shaping business strategies in light of the competitive landscape, not the shareholder list. In this article, Alfred Rappaport offers ten basic principles to help executives create lasting shareholder value. For starters, companies should not manage earnings or provide earnings guidance; those that fail to embrace this first principle of shareholder value will almost certainly be unable to follow the rest.

For the past 12 years, The Wall Street Journal has published Dr. Alfred Rappaport's brainchild, the Shareholder Scoreboard. This special section lists 1,000 of the largest U.S. Corporations (representing 90% of all listed equity values) and shows statistically how 'shareholder-friendly' each one is. The main goal of this paper is to propose value drivers (ratios) that can be used in shareholder value creation process in corporation.

Additionally, leaders should make strategic decisions and acquisitions and carry assets that maximize expected value, even if near-term earnings are negatively affected as a result. During times when there are no credible value-creating opportunities to invest in the business, companies should avoid using excess cash to make investments that look good on the surface but might end up destroying value, such as ill-advised, overpriced acquisitions. It would be better to return the cash to shareholders in the form of dividends and buybacks. Rappaport also offers guidelines for establishing effective pay incentives at every level of management; emphasizes that senior executives need to lay their wealth on the line just as shareholders do; and urges companies to embrace full disclosure, an antidote to short-term earnings obsession that serves to lessen investor uncertainty, which could reduce the cost of capital and increase the share price. The author notes that a few types of companies—high-tech start-ups, for example, and severely capital-constrained organizations—cannot afford to ignore market pressures for short-term performance. Most companies with a sound, well-executed business model, however, could better realize their potential for creating shareholder value by adopting the ten principles. Many firms sacrifice sustained growth for short-term financial gain.

For example, a whopping 80% of executives would intentionally limit critical R&D spending just to meet quarterly earnings benchmarks. They miss opportunities to create enduring value for their companies and their shareholders. How to cultivate the future growth your firm needs to succeed? Rappaport identifies 10 powerful practices. First among them: Don’t get sucked into the short-term earnings-expectation game—it only tempts you to forgo value-creating investments to report rosy earnings now. Another practice: Ensure that executives bear the same risks of ownership that shareholders do—by requiring them to own stock in the firm. At eBay, for example, executives have to own company shares equivalent to three times their annual base salary.

EBay’s rationale? When executives have significant skin in the game, they tend to make decisions with long-term value in mind.

The Idea in Practice Rappaport recommends these additional practices to create long-term growth for your company: • Make strategic decisions that maximize expected future value—even at the expense of lower near-term earnings. In comparing strategic options, ask: Which operating units’ potential to create long-term growth warrants additional capital investments? Which have limited potential and therefore should be restructured or divested? What mix of investments across operating units should produce the most long-term value?

• Carry assets only if they maximize the long-term value of your firm. Focus on activities that contribute most to long-term value, such as research and strategic hiring.

Outsource lower value activities such as manufacturing. Consider Dell Computer’s well-chronicled direct-to-consumer custom PC assembly business model. Dell invests extensively in marketing and telephone sales while minimizing its investments in distribution, manufacturing, and inventory-carrying facilities. • Return excess cash to shareholders when there are no value-creating opportunities in which to invest.

Disburse excess cash reserves to shareholders through dividends and share buybacks. You’ll give shareholders a chance to earn better returns elsewhere—and prevent management from using the cash to make misguided value-destroying investments. Launchgtaiv exe 1911 dll 64.

Fake id generator. Aspenone V8 License Generator Crack Rating: 9,0/10 9281 reviews. I installed the license and ran the software according to your video tutorial; 4. Installed the. Aspenone V8 License Generator Download Free. Range of heat exchanger design and rating software in the world. ASPENTECH ASPENONE HYSYS V8.4 FULL LICENSE. License file. To download AspenOne V. Html To download just the license generator. • Freshtime?2010-07-31 21:06:43 • Tag? Run the license generator and wait till its done. CEhEngineering Software Tutorial,training,download 2. Run the dvd/image/setup,whatever you are using. CEhEngineering Software Tutorial,training,download 3. FREE DOWNLOAD ASPENTECH ASPENONE HYSYS V8.6 FULL LICENSE GENERATOR Software aspenONE for engineering calculations and simulations are the basis for designing new processes or upgrading existing processes to improve their performance.

• Reward senior executives for delivering superior long-term returns. Standard stock options diminish long-term motivation, since many executives cash out early. Instead, use. These options reward executives only if shares outperform a stock index of the company’s peers, not simply because the market as a whole is rising. • Reward operating-unit executives for adding superior multiyear value.